I’ve been banging on about hVIVO (LSE: HVO) for quite a while now. This small-cap stock in the FTSE AIM Index is up 59% in two months and nearly 200% in 13 months.

Having first invested in this penny stock at 11p in December 2022, I was pleasantly surprised to see it end 2023 at 23p. Not bad for a UK small cap!

But it’s come flying out the traps in 2024, too, rising another 9% today (30 January).

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

Here, I’ll look at why the share price is moving higher and consider whether it could reach £1.

What is hVIVO?

Firstly, for those unfamiliar, the company is a global leader in testing infectious and respiratory disease vaccines and therapeutics using human challenge trials.

This is a type of clinical study in which some healthy volunteers are intentionally exposed to a specific pathogen (such as a virus) under controlled conditions.

This method can save its clients, which include a growing number of the world’s top biopharmaceutical companies, a lot of time and money when evaluating the efficacy of potential treatments or vaccines.

The company recruits paid volunteers for its FluCamp trial facility in London.

Positive trading update

Today, the company announced that it expects full-year revenue to reach £56m, up 15.5% from £48.5m in 2022. This is slightly ahead of previous market expectations.

Meanwhile, its EBITDA margins are forecast to expand to around 22% (from 18.7%).

At year-end, its weighted contracted order book reached £80m. And 90% of its 2024 revenue guidance is already contracted, while there’s also good visibility into 2025.

Another positive here is that the company plans to start paying regular dividends. It paid its first last year.

The path towards £1

Looking ahead, it intends to grow revenue to £100m by 2028. It says this will be achieved mainly through organic growth complemented by small, strategic bolt-on acquisitions.

Assuming the same price-to-sales multiple, that would result in a share price of about 49p by 2028. Or 72% above the current price, according to my rough calculations.

But as the only end-to-end human challenge services provider, hVIVO is increasingly useful to big pharma. So I think demand could increase rapidly and, crucially, it will soon move to a new state-of-the-art facility in Canary Wharf to meet this growing demand.

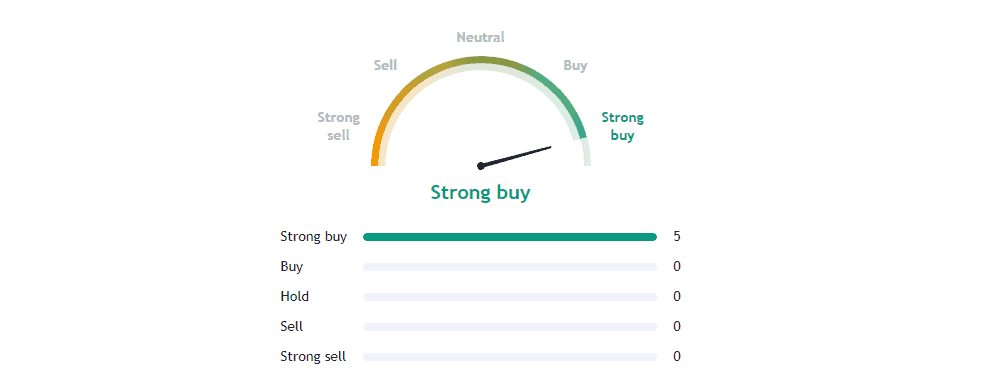

Therefore, I’m expecting more bullishness from analysts. Among the five currently covering the stock, it boasts a flawless ‘strong buy’ rating,

The stock is trading on a forward price-to-earnings of 18, which I think undervalues it. But if interest rates come down and money starts flooding back into the beaten-down small-cap sector, it could easily end up trading at a higher valuation.

That said, if interest rates stay higher for longer than currently anticipated, the positive share price trajectory could quickly reverse.

Nevertheless, growing dividends may attract new buyers, supporting a higher share price.

The balance sheet is excellent, with a cash balance of £37m at the end of 2023. A big contributing factor here is that the firm takes in upfront non-refundable quarantine booking fees from new contracts.

All this leads me to believe that the share price could one day reach £1. And if I didn’t already own this stock, I’d snap it up today and hold it long term.